If your employer offers a match in their 401 (k) plan, it's generally better to contribute as much as possible, at least until you maximize the match. This notice is intended to help you decide whether to do such a rollover.

401k Rollover How To Roll Over A 401k - Clark Howard

If you had stock option for best buy then you have a fidelity account, if you did then you can create a rollover account in fidelity and rollover your 401k and manage it your way or have fidelity do it.

Best buy 401k rollover. This is a critical time for climate action, and best buy is doing our part to save our planet and create a more sustainable world for our employees and the communities we serve. C/o best buy co., inc. Earn 70,000 american airlines aadvantage bonus best 401k rollover deals miles after spending $4,000 in purchases within the first 4 months of account opening.

Find out your 401 (k) rules, compare fees and expenses, and consider any potential tax impact. Unfortunately, some 401k administrators lack a sense of urgency when it comes to facilitating 401k rollover paperwork. Changing or leaving a job can be an emotional time.

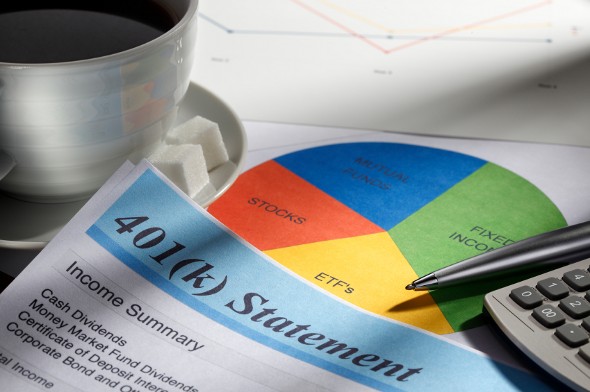

For 2020, the amount you can contribute begins to phase down when your annual income hits $124,000 for single filers and $196,000 for those married. In this summary, the plan sponsor and the other employers participating in the plan are called the participating employer group. the participating employer group includes best buy, bbes and. 401k can be rolled over.

$6500 / $6000 ~= 1.083, which is still a larger fraction than $20500 / $19500 ~= 1.051. That's why we're proud to become a founding member of the breakthroughs 2030: This notice describes the rollover rules that apply to payments from the plan that

Transfer to an ira or new jobs 401k if they offer. Individual 401k (for small business) stocks; You are receiving this notice because all or a portion of a payment you are receiving from the plan is eligible to be rolled over to an ira or an employer plan.

Rank among the top 401(k) funds: This type of account reduces taxes in the year the contribution is. Keep in mind that the limits can only increase by $500 increments.

First checked bag is free on domestic american airlines itineraries to reduce travel costs and boost your bottom line. You can cash it out if you want but remember it comes out of your income tax for next year. The roth ira has income rules for contributions.

$0 plus $0.65 per contract rollover ira; Obstinate administrators and bad company policies, however, have forced some investors to wait up to three months for their 401k rollover to be completed. 4 options for an old 401 (k):

Investors need to be aware what the annual maximum contribution is and not go over it. Vanguard offers 130 of its own mutual funds and 76 etfs, all of which are free to trade in a vanguard account. For tax year 2021, you can contribute $6,000 to a roth ira (or $7,000 for those age 50 or older) as long as.

Shop best buy for electronics, computers, appliances, cell phones, video games & more new tech. Keep it with your old employer, roll over the money into an ira, roll over into a new employer's plan, or cash out. The expense ratio represents the annual percentage your funds takes for.

Vanguard is a good choice for ira investors who want to invest primarily in vanguards family of mutual funds and etfs. 1698 employees reported this benefit. Keep it in there until you find a new job and you can apply for voya to roll it over.

You can judge a solid investment fund by its expense ratio and its average yearly performance. Best buy corporate campus 7601 penn ave. Retail campaign, a race to zero campaign that aims to accelerate climate action.

Merrill edge offers numerous 401 (k) and solo 401 (k) options for businesses. You can start a plan from scratch, or you can move an existing plan from another custodian.

A Basic Introduction To The 401k Rollover Walletgenius

Whats A 401k Rollover And How Does It Work Ellevest

Solo 401k Rollover Vs Contribution - Ira Financial Group

How To Rollover A 401k Into An Ira Nextadvisor With Time

10 Big 401k Plans Suspending Matching Contributions In 2020 - 401k Specialist

401k Rollover The Complete Guide 2021

How To Rollover Your 401k To A Roth Ira Can You Transfer It

Roll Over Ira Or 401k Into An Annuity Rollover Strategies

How To Roll Over Your 401k And Why Ally

The Best 401k Rollover Ideas Our Deer 401k Plan 401k Rollover 401k

The Complete 401k Rollover To Ira Guide - Good Financial Cents

401k Rollover To Ira Forbes Advisor

How To Rollover An Old 401k The Motley Fool

Dsosgd-aaflaem

Should I Roll Over My 401k After The Market Drops The Motley Fool

Rolling Over A 401k To An Ira - The Reformed Broker

How To Buy Bitcoin With A 401k Rollover - Youtube

401k - The Hr Capitalist

401k Rollover - Smartasset

Best Buy 401k Rollover. There are any Best Buy 401k Rollover in here.