Min of 650 qualifying fico score must be at least six months with current employer maximum purchase price of $239,000 first time home buyer only must be under maximum income limits $5,000 penalty if property sold within two years of closing 0% interest no payments as long as you live in the home dpa must be paid back in full when. Layton city grant eligible applicants will receive $5,000 in home buyer grant money that may be used towards down payment, closing costs or principal reduction.

Did You Know That The Majority Of First-time Homebuyers Are Millennials Thats Right Canadians Born Bet Mortgage Payment Mortgage Mortgage Payment Calculator

Va loans require a 620 credit score.

First time home buyer utah qualifications. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. This program provides valuable education for the first time home buyer and funding for closing cost or down payment assistance for your first home. It will have the lowest monthly payment, and your rate will never increase.

Must follow clearfield income limts and be a first time buyer. See income limit chart on application It can take upwards of years to save up a 20% down payment becoming the single biggest hurdle facing home buyers today.

The original idea is evolved, and the downpayment toward equity act of 2021 was introduced as a bill on april 14, 2021. Must be at least 18 years of age, or married to a person who is 18 years of age. West jordan first time homebuyer grant

How does a home buyer qualify for low down payment programs? Applicants must be a first time home buyer as defined by hud; Minimum 580 credit score (500+.

Join learners like you already enrolled. Home buying advice in todays market. Must not exceed income limitations for the area.

Buyers must have qualifying income, meet at least 600 credit score and occupy as primary residence. Ask your loan officer for additional qualifications. Choose from many topics, skill levels, and languages.

Must not have not owned a home in the last 36 months. Utah first time home buyer programs and grants. That link takes you to a list of.

Utah housing offers loans and down payment assistance to repeat home buyers, too. Give us a call now or complete the secure online form to see how much down payment money you can get. Down payment assistance may be available in your area.

Ad find the right instructor for you. Weber county first time homebuyer program. Fha loans are the #1 loan type in america.

A single parent who has only owned a home with a former spouse while married. Loan must be used to buy a primary residence in utah. If you are a utah first time home buyer, want a place to call home sweet home and need some mortgage assistance or a down payment grant you have come to the right place.utah is very aggressive when it comes to first time homebuyers and offers a variety of down payment grants and assistance.

Fha loans require a 640 credit score for a 3.5% down payment. For more information about the first time home buyer program, please contact jeff kearl at 435.752.7242. Utah first time home buyer programs, provo utah $10,000 home grant,provo utah $20,000 pioneer grant money,own in provo $10,000, neighborhood salt lake grant, six county sweat equity program, st george utah grant money, summit county mutual self help program, weber county $5,000 grant, own in odgden, davis county utah first time buyer grant, clearfield utah.

Yes, it's the same idea. The chenoa fund allows up to. Conventional loans require a 620 credit score.

Each program and participating lender may have different credit score requirements, income levels, etc. Its best to review all factors in qualifying for down payment money.

Listing Presentation Real Estate Marketing Canva Real Etsy Listing Presentation Real Estate Listing Presentation Real Estate Marketing

Pin On Buying A Home

Jumbo Loans Jumbo Loans Loan Jumbo

Mortgage Pre-approval Vs Mortgage Pre-qualification Whats The Difference Preapproved Mortgage Pay Off Mortgage Early Mortgage

Commercial Loans Commercial Loans Underwriting Pay Off Mortgage Early

Utah Housing Homeagain Loan Utah Home Grant

America Usa Suburb Houses Townhouse Residential Window Tint Residential Roofing

The Most Common Mistake To Avoid Is Hurrying Over Any Purchase Decisions Without Adequate Resear Real Estate Guide Real Estate Development Property Development

Loan Officer Marketing Plan Template Beautiful 27 Of Loan Ficer Marketing Plan Template Loan Officer Reverse Mortgage Marketing Plan Template

How To Get Pre-approved For A Mortgage In Utah Edgehomes

The Barn Utahs Most Expensive Home At 25m Is Unlike Any Barn Weve Ever Seen Expensive Houses Barn Aesthetic Mansions

Do You Have Questions About Buying A House Get A Better Understanding Of The Home Loan Process With The Help Of Our Home Buying Process Home Loans Home Buying

Four Ways For Financing A Fixer Upper Home Of Your Dreams Fixer Upper Finance How To Get Money

Usda Home Loans Near Greenville Nc Pitt County - Usda Home Loans In Nc Home Loans Greenville Greenville Nc

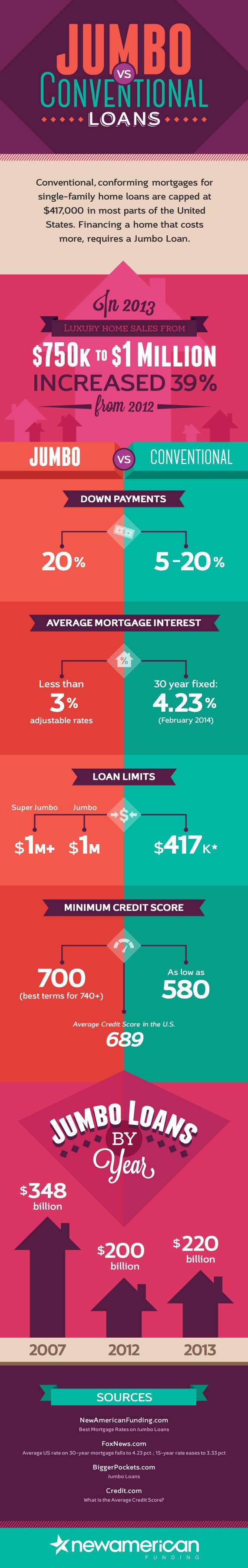

Jumbo Vs Conventional Loans Conventional Loan Jumbo Loans Finance Loans

First Time Home Buyer Utah Home Grants Buy Utah Homes

First Time Home Buyer Utah Home Grants Buy Utah Homes

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

Va Loans Va Loan Loan Closing Costs

First Time Home Buyer Utah Qualifications. There are any First Time Home Buyer Utah Qualifications in here.