You can even create a position that potentially profits if the market stays neutral. Options allow you to take a speculative market position using leverage.

/PutDefinition2-8a7d715894554ca990ef6946cc6a0306.png)

Put Definition

You are selling the call to an options buyer because your believe that the price of the stock is going to fall, while the buyer believes it is going up.

/PutDefinition2-8a7d715894554ca990ef6946cc6a0306.png)

Options buy to open meaning. However, high open interest doesn't necessarily mean the people trading that contract have the correct forecast on the stock. See buy to open order or sell to open order. Buying a put option gives the purchaser the choice to force the option seller to buy the stock.

For example, when you buy a call option, you open a long position and profits are realized from price appreciation. Buy it or sell it. Once you are long or short an option there are a number of things you can do to close the position:

Because options are derivatives, they receive their value through an underlying security. If an investor purchases 20 calls from xyz, they are buying the calls to open with each call representing 100 shares or 2,000 shares in total. A sell to open order is one in which you short sell a new options contract.

Regardless of your trading objective, you'll need a brokerage account that's approved to trade options in order to proceed with any strategy involving options. And if the price of that call option is $2.00, then you know that a lot of people are expecting that. Closing a bull put spread simply requires you.

This purchase will add 20 to the open interest number. After all, for every option buyer expecting one result, there's an option seller expecting something else to happen. What is a sell to open put option?

When investors purchase or sell options, each transaction is recorded as either an opening or closing transaction. They could also reap profits from bear markets or declines in the prices of individual stocks. You can buy options contracts by simply choosing exactly what you wish to buy and how many, and then placing a buy to open order with a broker.

You should also understand the risks associated with put option investing, though. While a call option buyer has the right (but not obligation) to buy shares at the strike price before or on the expiry date, a put option buyer has the right to sell shares at the strike price. Buying to open an options position means that you're purchasing the contract.

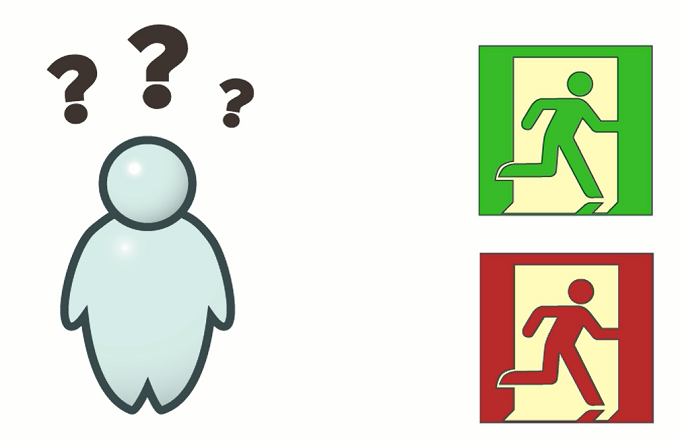

That can be selling to open a call (bearish trade) or selling to open a put (bullish trade). An order that is used to open a new position. The actual orders used would be "buy to open or "sell to open.

This order was named as such because you are opening a position through buying options. Stock options are choices that investors sell to each other. Since options contracts are bought and sold on a marketplace by market participants, it means that participants can either buy/sell an existing contract or create their own.

Stock that has options based on. On the contrary, a put option is the right to sell the underlying stock at a predetermined price until a fixed expiry date. You're now long either a.

When you buy to an option, you pay premium to initiate the trade and obtain the rights of the option. If the price of that call option is $0.25 then not many people are expecting yhoo to rise above $30; 1) close it with an offsetting trade 2) let it expire worthless on expiration day or, 3) if you are long an option you can exercise it.

When you open an option position you have two choices: When you sell a call option it is a strategy that options traders use to collect premium (money!) it is the opposite strategy of buying a put and is a bearish trading strategy. An options contract is defined as an agreement between two parties for a potential transaction of the options contract's underlying asset at a predetermined price (the strike price strike price the strike price is the price at which the holder of the option can exercise the option to buy or sell an underlying security, depending on) on or.

Buying to open an options position can offset or hedge other risks in. Buying put options is a way to hedge against a potential drop in share price. A measurement of the total number of open positions relating to a particular option.

Read more about open interest. High open interest for a given option contract means a lot of people are interested in that option. Use the buy to open transaction order when you want to purchase a call or put option.

If you buy a put, you assume a bearish stance, with gains banked from falling asset prices. sell to close is when. In contrast to buying calls and puts, selling options is counterintuitive.

You're the owner, and have the right to place an order to sell the contract back into the market, to exercise the contract, or to let it expire. The phrase buy to open refers to a trader buying either a put or call option, while sell to open refers to the trader writing, or selling, a put or call option. Buy to open lets you establish a long or short position in the.

Exercising Stock Options Everything You Should Know Carta

4 Ways To Trade Options Differences Explained

/95528215-5bfc2b71c9e77c002630606b.jpg)

4 Ways To Trade Options Differences Explained

Short Selling Stocks - A Short Selling Example Firstrade

/77005273-5bfc2b8d4cedfd0026c11921.jpg)

Buy To Open Definition

Options Trading - Call And Put Options - Basic Introduction - Youtube

How To Trade Options Making Your First Options Trade - Ticker Tape

/ShortSellingvs.PutOptions-eff3cf41a5f549978c295eef47fbc2bd.png)

Short Selling Vs Put Options Whats The Difference

How To Trade Options Making Your First Options Trade - Ticker Tape

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

Short Put Definition

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

Long Put Definition

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Put Option Vs Call Option When To Sell

Open Interest Varsity By Zerodha

How To Trade Options Making Your First Options Trade - Ticker Tape

What Is Option Trading A Beginners Guide Ally

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Gerund And Infinitive With Changes Of Meaning - English Esl Worksheets For Distance Learning And Physical Classrooms

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

Beginners Guide To Call Buying

What Is Option Trading A Beginners Guide Ally

Options Buy To Open Meaning. There are any Options Buy To Open Meaning in here.